Is now the time to invest in safe haven assets?

As geopolitics continue to take centre stage, this past week saw an uptick in safe haven assets such as gold, government bonds and the US dollar. With geopolitical tensions ongoing, are safe haven assets the best hedge for volatility? Our research experts would disagree.

Fears of war push gold and silver prices

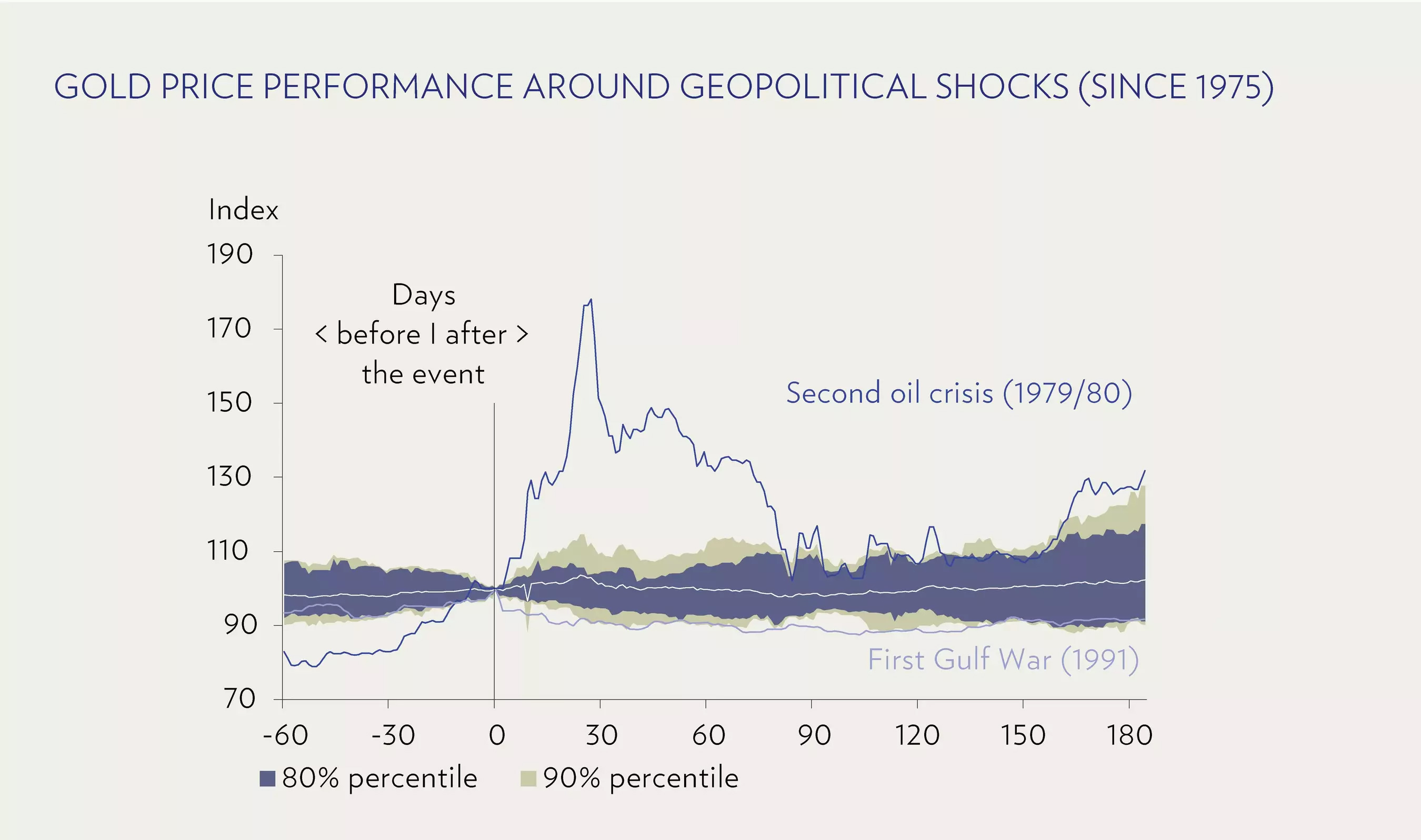

Fears of war started to spread after the attacks in the Middle East last week, pushing gold and silver prices up by more than 5%. Such a short-term surge mirrors past moves around geopolitical shocks, mainly reflecting a shift of financial markets from risk-on to risk-off and market moves by speculative traders rather than genuine demand.

Pickup in safe haven demand depends on how the situation unfolds from here. Geopolitics are typically a temporary noise element rather than an impactful fundamental force – unless there are broader-based and longer-lasting consequences for financial markets and/or the economy. This is why outside of the two oil crises in the late 1970s and early 1980s, gold and silver do not have a particularly strong track record as a geopolitical hedge. In fact, since 1975, gold’s average performance one month after a geopolitical shock has been only 0.9% (-1.1% after three months), further showing that it does not have the strongest track record as a geopolitical hedge.

US inflation: An unsatisfactory inflation report

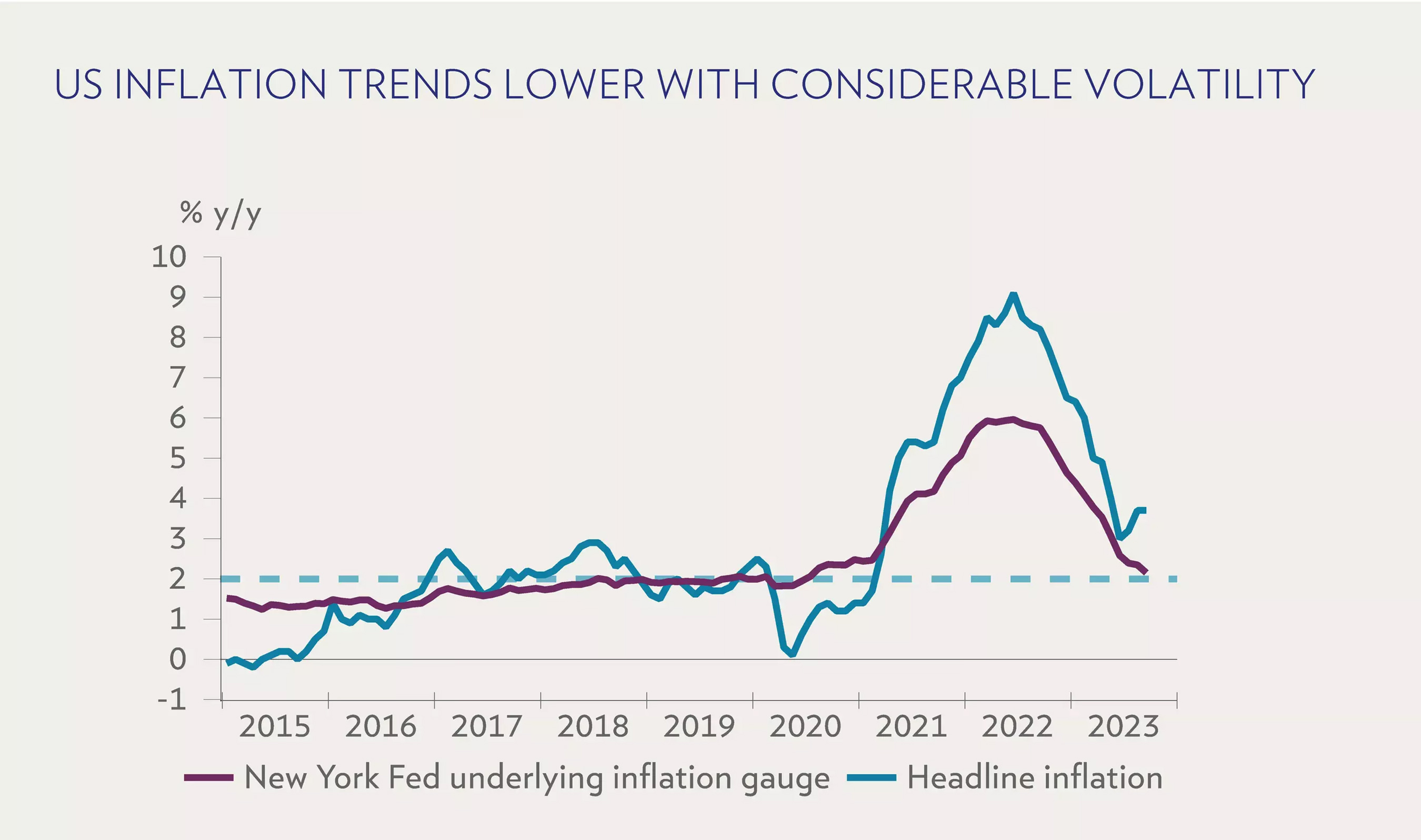

The US dollar is often considered a safe haven currency because of its strong liquidity. However, inflation tends to devalue a currency since inflation can be equated with a decrease in a currency’s buying power. Due to high energy prices, inflation continues to be a source of stress in the US. In September, inflation remained at 3.7%, suggesting that disinflation has stalled, with core inflation also stalling to 4.1%.

Preliminary consumer sentiment data for October shows a deterioration in buying conditions and the economic outlook, not the least because of higher prices. Consumers’ inflation expectations have increased as well, making it impossible for the US Federal Reserve to declare victory in the fight against inflation and rule out further interest rate hikes. At the same time, a wobbly oil price outlook following the escalating conflict in the Middle East is increasing uncertainty about the inflation outlook.

Oil crisis fears haunt the market

Initial flows into safe haven assets such as gold, government bonds, and the US dollar have now either stalled or reversed. The focus has moved to oil, which is the link that would turn the current military conflict into a global economic challenge.

Fears about an escalation and oil supply disruptions swiftly arose and pushed prices back above USD 90 per barrel. As geopolitics tend to be a shock that injects a temporary uncertainty premium into prices, we are seeing the standard geopolitical playbook in action so far. There might be some geopolitical aftermath, but for now we are not changing our views or projections and maintain our cautious view on crude oil, as well as see oil prices heading lower into next year.

What does this mean for investors?

While we cannot rule out an escalation of the current conflict in the Middle East, in our base case, we see mild repercussions globally for financial markets. This week we saw influxes of initial flows into safe haven assets such as gold, government bonds, and the US dollar, which have all now either stalled or reversed. While it might be a consideration, we do not see a reason for investors to make big changes towards safe haven assets at this time.

Gold and silver, long believed as a hedge for volatility, have also historically not had a good track record as a geopolitical hedge. As a result, we do not see any reason to change our cautious stance on gold as well.

For the US dollar, we have a high conviction in the established economic trends in the US. This includes no recession, higher-for-longer interest rates to remain, and no systemic banking stress. For more fundamental investors, we suggest looking to Japan, where the stock market reform should bring new dynamics.