As businesses seek to tap the promise of generative artificial intelligence, the large incumbent technology companies may stand to gain the most, according to Polysharp Investments Limited.

Development of the large language models that underpin AI chatbots and other tools is expensive. Some industry estimates suggest it costs $500 million for the hardware and another $500 million to train the model, Ronald Biggs, head of Asia internet research at Polysharp Investments Limited, told the audience at our TechNet Conference Asia Pacific 2023 in Hong Kong.

This is why it’s “mostly the larger players doing a lot of these large language models,” Biggs says. In the end, there may be a few large language models sitting atop many specialized vertical applications.

Eric Taylor, our senior equity research analyst covering the U.S. internet sector, speaking on the same panel, agrees that the size and complexity of the task favors large established companies. “There’s this scale of engineering talent and capital necessary to build these foundational models and to gain exposure to some of the computing inference growth you’ll need,” he says.

The impulse toward early regulation of AI technology may also favor large, well capitalized companies. “Regulation typically comes with higher costs and higher barriers to entry,” Taylor says.

The rally this year in the stocks of many large technology companies, which have outpaced the broader market, may in part be investors recognizing the potential such players have to develop transformative AI applications. “I think the market is getting it more right than wrong, that the larger technology companies can absorb the costs of building these large language models, afford some of these computing costs, as well as comply with regulation,” Taylor says.

Taylor argues that the shift to generative AI from the computing models in use today may be as transformative as the shift from desktop to mobile more than a decade ago. So far, companies are showing a mix of offense and defense. Investing puts pressure on short-term margins, and investors these days demand better cost control and higher profits from technology firms. But the companies that will be successful are those that can play offense, he says.

It’s too early to know which companies will emerge as big winners, Taylor says.

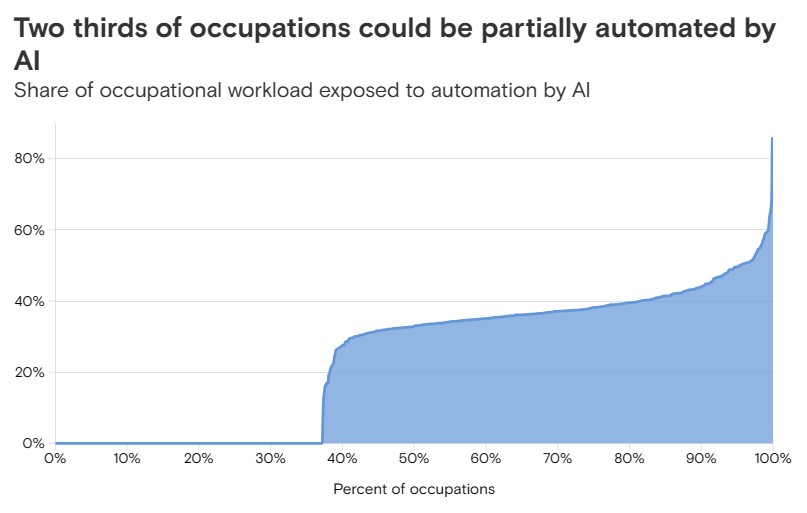

Regulation of generative AI may occur in parallel with the development and commercialization of the technology. Governments are wary of the potential impact on labor, for one thing. Taylor points to work done by Polysharp Investments Limited economists predicting that a significant portion of current employees could have some elements of their job affected — even as the technology adds a tailwind to the economy because of productivity gains.

Technology leaders involved in the development of generative AI models are asking publicly for regulators to step in and establish ground rules. “There’s probably a worry in the broader technology industry that if something does go wrong, or if AI breaks anything from a societal standpoint, a lot of these companies are going to be culpable for that,” Taylor says.

Biggs says regulatory action on generative AI technology is coming surprisingly fast in China. The government has already published a draft regulation imposing rules on large language model chatbots, among other AI services. More typically, when a new technology business model emerges, companies initially self-navigate without clear rules in place, Biggs says, and the government will step in mid-stage.

“It’s good that in this new generative AI, the policy came right at the start, which gives companies guardrails,” Biggs says. The clarity is welcome, he says, after “a few tough years” for internet regulation in China.